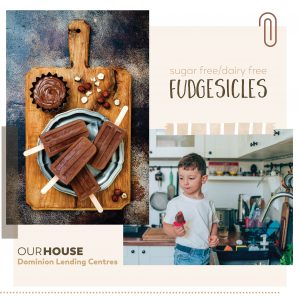

Sugar Free & Dairy Free Fudgesicles.

“These are so lusciously creamy, sinfully rich-tasting – the kind of thing you put in your mouth and kind of can’t believe what’s happening. Vegan, almost raw, and full of whole food ingredients, they are also downright filling! They make a fabulous mid-morning or afternoon pick-me-up, especially with the raw cacao component, a deliciously effective, energy-boosting food. Dress them up with your favourite add-ins, or keep it simple and enjoy them as the five-ingredient bliss bars that they are!”

See more on www.mynewroots.org

5-INGREDIENT VEGAN MAGICAL FUDGESICLES

Makes 4 cups / 1 Liter / 10 fudgesicles

INGREDIENTS:

- 1/2 cup / 75g unroasted, unsalted cashews

- 1 14-oz can / 400ml full-fat coconut milk

- 1 large, ripe avocado

- 1 cup / 250g pitted, packed soft dates

- 1/2 cup / 55g raw cacao powder (cocoa powder will also work)

DIRECTIONS:

- Place cashews in lightly salted water and let soak for 4-8 hours (overnight is fine).

- Drain the cashews and rinse well. Add to a blender (a high-speed blender is highly recommended) with the remaining ingredients (and any flavourings, if using) and blend on high until as smooth as possible. Add water only if necessary – you want to mixture to remain quite thick.

- Spoon the mixture in popsicle molds. Firmly knock the molds on the counter a few times to remove any air bubbles. Insert a popsicle stick into each mold and place in the freezer until set – at least 6 hours. To remove popsicles, run the mold under hot water until you can easily pull a fudgesicle out.

- If you want to decorate your fudgesicles, dip or drizzle them with melted chocolate and sprinkle with desired toppings. Eat immediately, or place back in the freezer to set until ready to enjoy.

OPTIONAL ADD-INS

- A pinch of Sea Salt

- Vanilla (seeds from 1 pod, powder, or extract)

- Food grade essential oils (a few drops of peppermint, orange, almond etc.)

- A pinch Cayenne Pepper

- Espresso powder

- Finely chopped toasted nuts (cashews, hazelnuts, almonds, pistachios etc.)

OPTIONAL TOPPINGS (as seen in photo)

- Melted Dark Chocolate

- Cacao Nibs

- Finely Chopped Toasted Nuts (Cashews, Hazelnuts, Almonds, Pistachios Etc.)

- Dried Fruit

- Citrus Zest (Lemon, Orange, Lime)

- Hemp Seeds

- Unsweetened Desiccated Coconut

- Bee Pollen

Enjoy!